EPEX SPOT operates organized short-term electricity markets for Central Western Europe, Great Britain, the Nordics and Poland. We offer a large range of products, to trade across the entire value chain of electricity.

Day-Ahead trading

EPEX SPOT offers Day-Ahead trading in thirteen European countries. Day-Ahead markets are operated through a blind auction which takes place once a day, every day of the year. The traded electricity is delivered on the next day. Apart from Switzerland and Great Britain, all markets are part of the Multi-Regional Coupling (MRC) which stretches across 19 markets from Portugal to Finland and from The Netherlands to Italy. All auction markets of EPEX SPOT run on the ETS trading system, a robust and reliable trading platform.

Our Day-Ahead offer at a glance

-

Robust and reliable trading guaranteed on our EPEX Trading System (ETS)

-

Optimized EU Market Coupling with our implicit auctions - ensuring the best use of interconnection capacity and most efficient use of your assets

-

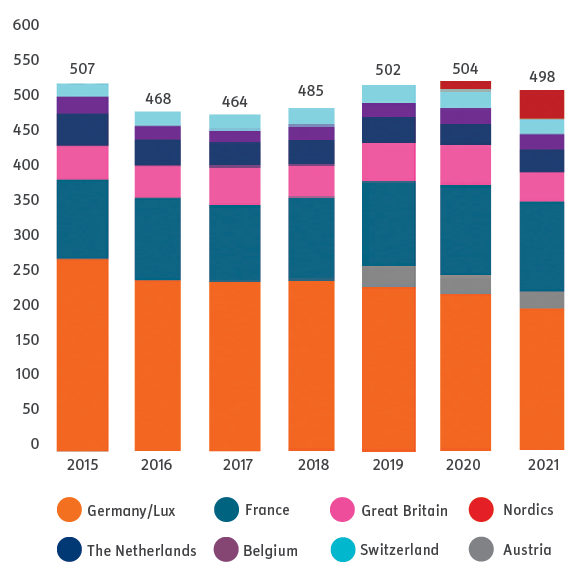

Highest liquidity and diversity of portfolios with over 500 TWh traded per year representing a third of the consumption of the thirteen countries covered

-

Widest product offering from single hours and blocks to smart and big blocks: exclusive, linked, loop & curtailable

-

Easy access to your order submissions & results through our API

Hourly Day-Ahead auctions

Tradable contracts: 24 hourly contracts corresponding to the 24 delivery hours of the following day – traded either in single hours or in blocks of combined hours

Closure of orderbook: daily at 12:00 (CET) (9:20 GMT for Great Britain, 11:00 CET for Switzerland) in D-1

Publication of results: from 12:57 (CET) onwards (9:30 GMT for Great Britain, 11:10 CET for Switzerland)

See our Market Results published daily.

Half-hour Day-Ahead auction in GB

Following the Day-Ahead auction, the Half-hour Day-Ahead auction in Great Britain gives members the opportunity to balance their physical portfolios and to further optimize their generation portfolio.

Tradable contracts: 30-minute contracts, with delivery on the following day

Closure of orderbook: daily at 15:30 (GMT) in D-1

Publication of results: from 15:45 (GMT) onwards

Blocks

Classic block orders encompass several hours at the same price with flexible volume profiles and are executed at the same ratio on all its hours. Smart & big blocks are unique to our auctions because of their complexity and unparalleled size – allowing you to sophisticate your optimization strategy.

Big blocks: larger than classic blocks with the maximum size going up to 1500 MW and allows to cover large production capacities

Loop blocks: families of two blocks which are executed or rejected together. They allow to bundle buy and sell blocks to reflect storage activities - only offered at EPEX

Curtailable blocks: set of blocks which can be either entirely executed or entirely rejected (All-or-None); or executed above a minimum acceptance ratio defined by traders

Linked blocks: set of blocks with a linked execution constraint, meaning the execution of one block depends on the execution of its father block. They allow to represent the variation of electricity generation with regards to the market price

Exclusive blocks: group of blocks within which a maximum of one block can be executed, so your electricity is traded at the most profitable moment

Traded volume on the EPEX Day-Ahead

-

-

You can download :

-

Intraday trading

The Intraday market segment at EPEX SPOT offers both continuous and auction trading in twelve European countries. All continuous Intraday markets of EPEX SPOT run on the M7 trading system, the highest industry-standard in terms of performance. These markets are by far the most liquid in Europe.

Our Intraday offer at a glance:

-

Most liquid orderbook in Europe from opening to delivery time, running 24/7 to support the most advanced trading strategies

-

Highest performing Intraday continuous trading system (M7) with more than 1,000,000 orders submitted every day

-

Multiple contract types offering finer granularity and increased flexibility

-

Versatile, performant and standardized API services for order submission and results retrieval

-

Wide range of Intraday auctions allowing you to further optimise your Intraday portfolio while benefitting from a robust reference price

Intraday continuous

All continuous Intraday markets run on the M7 trading system. Our M7 trading system provides our members with the most robust and reliable platform supporting the most advanced trading strategies.

Tradable contracts: hourly contracts, half-hourly contracts and 15-minute contracts

Trading opening: 00:00 (GMT) D-1 in GB / 14:00 (CET) D-1 in the Nordics / 15:00 (CET) D-1 in CWE

Closure of orderbook: up until 0 minutes before delivery start of the contract

Trade execution: as soon as two entered orders match on our platform, the trade is executed

SIDC – The pan-European Single Intraday Coupling

EPEX SPOT is part of SIDC, an initiative enabling cross-border trading in one integrated European Intraday market. This solution links the local trading systems operated by Power Exchanges with the available cross-zonal transmission capacity provided by Transmission System Operators. You can find more information on SIDC here.

Intraday auctions

We offer a full suite of Intraday auctions in CWE & GB, completing your trading value chain at EPEX SPOT. With the increasing number of renewable assets, these products are key in reinforcing the Intraday reference price, optimising the short-term market and facilitating the energy transition.

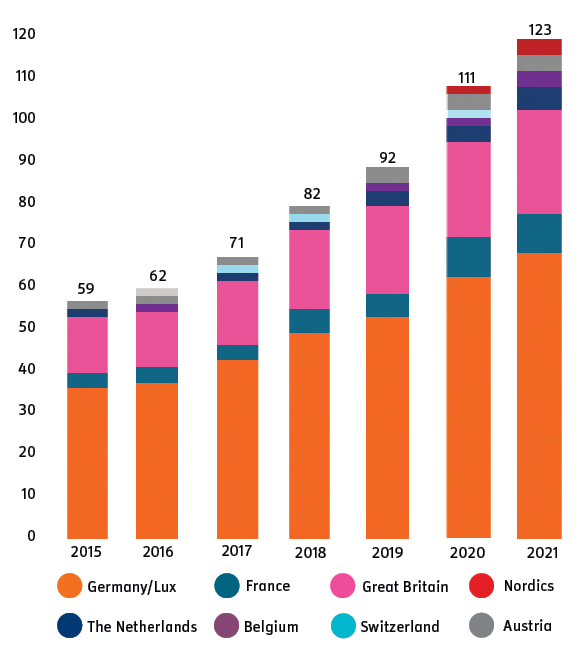

The first Intraday auction was introduced in Germany in 2014. Since its launch and others in Great Britain and Switzerland, we have seen a significant growth in liquidity on this market segment – reaching a total traded volume of nearly 7 TWh in 2019. These auctions play a key role in providing further contracts granularity and balancing opportunities. In 2020, we expanded our Intraday auctions to Austria, Belgium, France and The Netherlands, further completing our offering in Europe.

Local Intraday auctions in Austria, Belgium, France, Germany, The Netherlands and Switzerland

- Austria 15 min – daily at 15:00 (CET)

- Belgium 15 min – daily at 15:00 (CET)

- France 30 min – daily at 17:00 (CET)

- Germany 15 min – daily at 15:00 (CET)

- The Netherlands 15 min – daily at 15:00 (CET)

- Switzerland 60 min – daily at 17:40 (CET)

- Switzerland 60 min – daily at 10:30(CET)

Intraday auctions in Great Britain coupled with Ireland

- Great Britain 30 min – daily at 17:30 (GMT)

- Great Britain 30 min – daily at 8:00 (GMT)

Please find the detailed product specifications available in the Downloads section on the website in your Member Area.

Traded volume on the EPEX Intraday

After-Market trading

The After-Market provides additional flexibility to market participants by allowing trading after delivery. Contracts are available for trading as of the physical delivery of the contracts until the next trading day through the unique EPEX SPOT M7 continuous trading system. It enables the adjustment of your physical positions in the ex-post timeframe, thus reducing costs related to imbalance settlement. In the Netherlands, After-Market allows market participant to further optimize in case of dual-pricing for imbalance settlement.

Belgium

-

Trading start: Delivery start of the Intraday continuous contract

-

Trading end: 12:30 day after delivery (D+1)

The Netherlands

-

Trading start: Delivery start of the Intraday continuous contract

-

Trading end: 8:30 day after delivery (D+1)

Guarantees of Origin Spot Market

For more and more end consumers, it’s increasingly important to know where their electricity comes from, and if possible, to make a choice to switch to renewable energy completely.

However, since one cannot distinguish the source of an electron once it is injected into the network, European legislation came up with a green label called Guarantees of Origin (GOs) to enable the tracking of the origin of renewable electricity.

GOs have their challenges

The GOs tracking system brings major benefits, the most important one being that GOs allow consumers to be certain that the energy they use stems from renewable energy sources.

However, this system also has some limitations.

Indeed, until now most GOs have been traded on the OTC market, leading to a lack of transparency due to no obligation to make such GOs prices public. As a consequence, market participants are not able to know the true value of their green assets.

Today’s demand for renewables is also multi-faceted, with some wanting very specific country, region or production technology for the renewable source, while other are happy with more generic criteria of origins. This diversity of needs may be sometimes difficult to satisfy. For example, demand for cheap GOs mainly matches the numerous offers from old renewable plants, and this doesn’t allow for fully supporting new investments needed to reach the EU target of 32% renewable energy consumption by 2030.

Using our expertise to offer a solution and serve our trading community

To meet the market’s demand for more trading standards, increased transparency and robust price signals, on 28 September 2022, we successfully launched the first monthly GOs spot auction. This new market facilitates safe and seamless GOs trading across Europe, while satisfying the variety of needs for specific or generic GOs.

Our innovative market design optimally pools a wide range of generic and specific needs of market participants – fostering market liquidity to enshrine the use of GOs and support the acceleration of the energy transition.

This GOs spot auction matches today's market needs and is fit for tomorrow's evolutions.

GOs spot auction design

The monthly EPEX SPOT GOs auction is three-dimensional. That means that the product specifications take into account the following features:

- Generation technology (wind / solar / hydro)

- Country (country 1 / country 2 …)

- Subsidy scheme (subsidy / no subsidy)

Market participants can either submit bids for generic products, meaning any type of technology, country of origin or subsidy scheme; or bid for specific GOs combining the different product characteristics. After the bids are submitted, specific and non-specific bids can be matched and the corresponding transactions are processed.

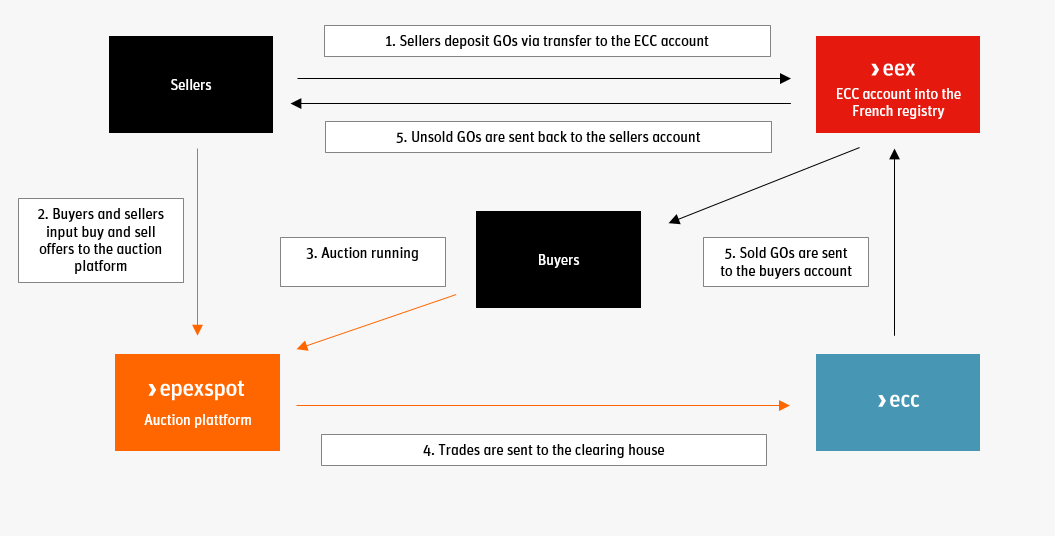

GOs spot auction process

The GOs spot auctions are held once a month and operated by EPEX SPOT under the exchange’s membership and market rules. Clearing and settlement is conducted by our group clearing house, ECC, and the GOs delivery is ensured through our French GO registry (held by EEX).

Indices

To know more about the calculation methodology of the GOs indices click here.

Do you want to sign up for this market? Contact sales@epexspot.com to get started.

French Capacity Market

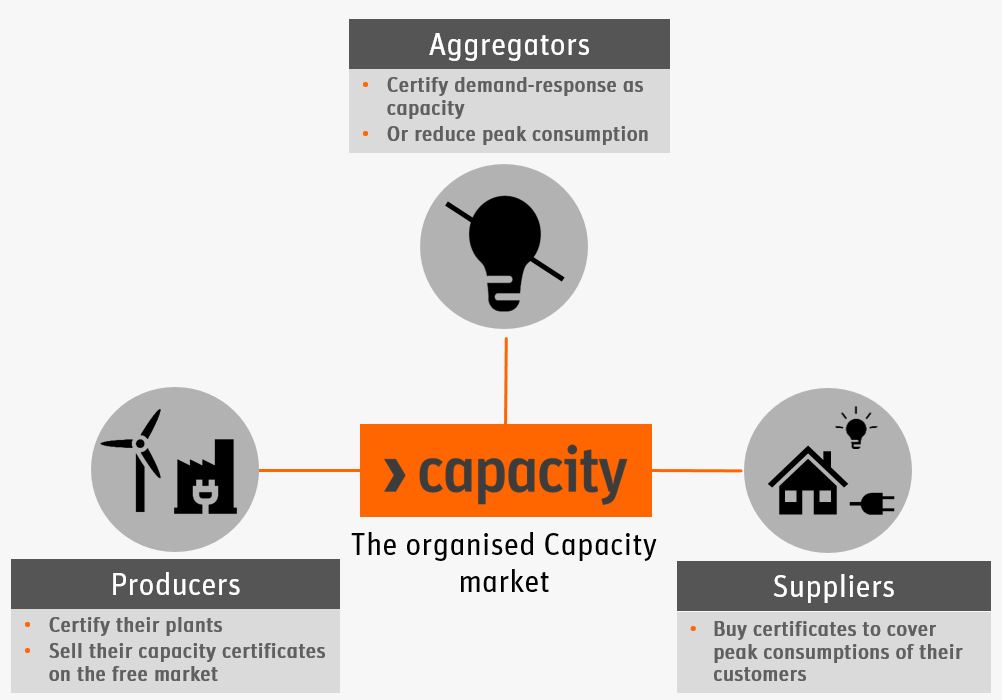

An organized market for French capacity guarantees.

The French law foresees a capacity obligation scheme. It specifies that electricity producers and demand-response operators receive capacity certificates by the French Transmission System Operator RTE. Suppliers have to contribute to security of supply by holding sufficient capacity certificates to cover the peak consumption of their costumers for each underlying year.

On the capacity market operated by EPEX SPOT, the demand for capacity guarantees meets the offer, determining a price for capacity which reflects security of supply needs to cover peak consumption in France.

The results of the past auctions are listed here.

The current Auction Calendar is available here.

If you wish to trade on the French capacity market, please get in touch with your Key Account manager or send an e-mail to sales@epexspot.com. You can find more information on the capacity market in our dedicated brochure and in the download section.

Detailed product specifications are available in the member section.

Future-to-Spot Service (formerly Physical Fulfilment)

The Future-to-Spot Service (FTS Service) is a service provided by EEX and EPEX SPOT where you can fulfil your Futures positions on the Day-Ahead auction to complement your volumes traded directly through the EPEX SPOT Trading System (ETS).

How does the FTS Service work?

Trading participants active on both EEX and EPEX SPOT markets are able to enter bids in the corresponding Day-Ahead auction according to the participants' respective position in an EEX power futures contract. The creation and forwarding of the required bidding sheets can be done automatically by EEX or manually via the Trading Participant. Download our User Guide to learn more about the process.

The FTS Service is offered in 7 countries across Europe: Austria, Belgium, France, Germany, Great Britain, The Netherlands, Switzerland – with Poland coming soon!

Localflex trading

An innovation powered by EPEX SPOT

Through our solutions flexibility service providers gain news opportunities to value their flexible assets and system operators obtain new tools to manage congestions and optimize grid planning.

Starting 2017, EPEX SPOT collaborated on various initiatives to develop marketplaces where flexibility demand and supply could meet on neutral and transparent flexibility markets. With Enera and Enflate, its first pilot projects for flexibility markets, EPEX SPOT has developed its expertise to efficiently manage local congestions and peak load in the power grid for Europe.

Since 2023, Localflex Continuous NL market, centralizes flexibility offers where and when needed in the Netherlands, using M7 continuous platform, connected to GOPACS.

Moreover, EPEX SPOT’s Localflex is completed by the LEM platform, an end-to-end solution for auction market, Localflex fosters the integration of renewable energy sources and increases the engagement of consumers and producers in congested grid areas such as Great Britain, where EPEX SPOT has established a partnership with UK Power Networks, the leading electricity distributor in London, the South East and East of England.

Organisation of EPEX Local Flex

You are a Flexibility Service Provider and you want to learn more about our Localflex trading offers ? Download our brochure or send us an email : sales@epexspot.com