Experts of the International Renewable Energy Agency shed light on the intricate geopolitics of critical materials in Europe and beyond.

The energy transition requires rapid growth in the supply of some critical materials. Critical materials are characterised by the risk of supply disruptions, the challenging substitution, the substantial efforts required for extraction, and the imperative to rapidly scale up production to meet escalating demand.

In some instances, their scope of applications is confined, while in others, it spans across multiple technologies. For instance, materials such as lithium, graphite, nickel, and manganese, demands are closely intertwined with lithium-ion batteries, rare earth metals find utility in permanent magnets for EVs, and wind turbines, and platinum and iridium play a pivotal role in hydrogen electrolysers, while copper has diverse applications ranging from solar panels to grid infrastructure.

IRENA’s report, Geopolitics of the Energy Transition: Critical Materials, sheds light on the intricate geopolitics surrounding these materials, addressing the challenges and policy considerations that arise as global demand for renewable technologies and energy storage escalates.

As highlighted in the IRENA’s World Energy Transition Outlook 2023, under IRENA’s 1.5°C scenario, renewable energy installed capacity must quadruple by 2030, a four-fold increase from 2020, and the stock of EVs must increase from 18 million in 2020 to 360 million by 2030.

Have you read?

Soaring electricity demand must be ‘good citizen of the grid’ says California energy chief

Modest progress being made in power sector collaboration – Breakthrough Agenda

Development Dynamics

According to IRENA’s Critical Materials for the Energy Transition technical paper, the natural resources necessary for the energy transition exist and will not be a showstopper for its progress. However, challenges arise from physical limitations that may hinder meeting the rising demand in the short to medium term.

At the forefront of these concerns is the looming potential for under-supply of some materials in the short to medium term, an issue fundamentally rooted in underinvestment in upstream activities. Several factors contribute to this potential undersupply, including the long lead times required to open new mining facilities and establish new supply chains, price volatility, uncertainty regarding future demand, lack of downstream transparency, and local opposition, among other factors.

Assessing the supply and demand dynamics of critical materials regularly is crucial, as disruptive innovations — already occurring on a significant scale — have the potential to alter demand. These disruptive innovations occur through critical material substitution, efficiency improvements, design optimisation, and the introduction of new materials. Such changes can transpire rapidly, as seen in the case of lithium-ion batteries.

No nickel or cobalt

Consider the case of lithium iron phosphate batteries: unlike conventional lithium-ion batteries, they don’t require nickel and cobalt. This innovation coupled with effective policy interventions — predominantly in China — propelled their global market share for passenger EVs from 6% in 2015 to 40% in 2022, reported BloombergNEF in their Electric Vehicle Outlook 2023.

While uncertainty surrounds the timing, nature, and scale of forthcoming technologies, as well as their impact on demand, it is evident that innovation can play a pivotal role in curbing critical material requirements, thus alleviating potential supply shortages. Zooming out to the long-term, circular economy approaches will have to take a more expansive role, embracing advanced and widely adopted methods for reducing, reusing, and recycling critical materials.

The landscape of critical material supply is interwoven with geopolitical intricacies, accentuated by a range of potential supply vulnerabilities — from natural disasters to political instabilities, from resource nationalism to market manipulation.

The geopolitical implications of the current critical material supply chain are heightened due to its concentrated structure, which is primarily evident in two distinct dimensions.

Firstly, the mining and processing of critical materials are geographically concentrated within a handful of nations. This is particularly evident in the case of materials like cobalt, graphite, nickel, lithium, dysprosium, neodymium, platinum, and iridium, for which one country — China — dominates at least 50% of the mining and/or processing activity.

Secondly, the supply chain is dominated by a select group of key players. For example, five companies control more than 60% of lithium mining, while another five companies dominate nearly 80% of platinum mining. A glimmer of hope lies in the diversification of mining and processing activities, stemming from the widespread distribution of critical material reserves.

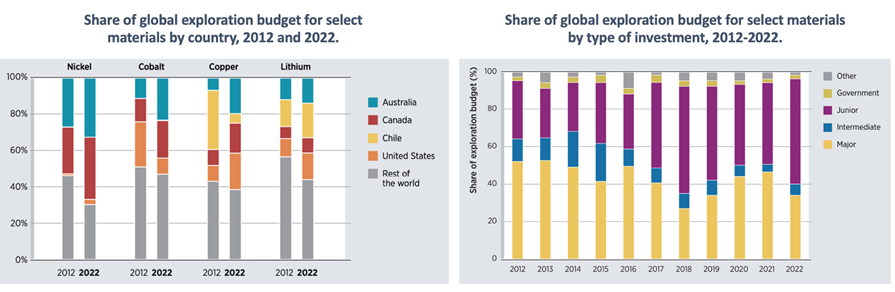

Exploration budget allocations mirror this trend and provide valuable insights into the ongoing drive toward diversification. An increasing number of countries, such as Gabon, Peru and Poland have become involved in nickel exploration while Ivory Coast, Morocco and Sweden are now investing in lithium exploration, showcasing the rise of new market players.

Increased investment in critical material exploration, will lead to the development of new mining projects. Certain regions remain underexplored: Africa, despite constituting 20% of the world’s land mass, received only 10% of exploration budgets in 2022, according to S&P Global’s Africa- mining by the Numbers 2022 research.

Source: IRENA, Geopolitics of the Energy Transition: Critical Materials report, 2023

The type of companies involved in exploration is also changing, shifting away from major and government companies, towards junior miners. In 2022, junior miners accounted for more than half of the exploration budget share for lithium, cobalt, and nickel, contributing to risk diversification.

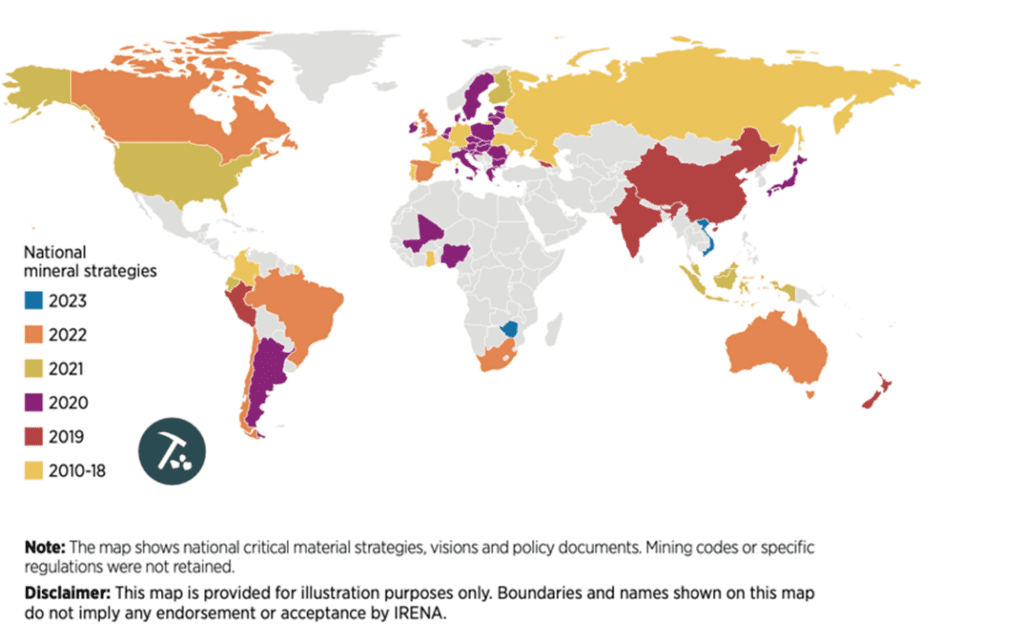

Many countries are starting to develop strategies to mitigate supply risks by developing strategies to secure access, putting domestic production at centre stage, and reducing import dependencies on a single supplier or country. For instance, in line with their Critical Raw Materials Act, the European Union targets 10% domestic mineral extraction and 40% local processing by 2030.

Developing countries are taking steps to maximise the benefits of the mineral resources by applying export restrictions, to attract domestic investment in processing and other downstream activities. However, the actual effectiveness of this strategy remains uncertain, and it may lead to higher prices as costly processing infrastructure needs to be developed.

Redefining responsibility

The mining industry is often associated with the potential for adverse environmental impacts, displacement of local communities, and human rights abuses against indigenous populations. The increased demand for critical materials from the energy transition heightens concerns about the potential negative impacts of this increased demand.

This situation presents an opportunity to rewrite environmental and social standards of extractive industries making it more inclusive, ethical, and sustainable. “It is absolutely essential that we rewrite the legacy of the mining industry, so that mineral-rich countries can capture more of the economic value,” says Elizabeth Press, Director of Planning and Programme Support at IRENA, and author of the report on critical minerals.

“We see a greater awareness from all sides that things cannot continue as they were,” says Press.

Considering that a substantial fraction of mining projects are situated in territories owned by indigenous communities, ensuring proactive community engagement throughout the entirety of mining projects is of the utmost importance.

Diving further into the industry’s complexities, estimates indicate that over 45 million people across 80 countries are involved in artisanal small-scale mining (ASM), an unregulated sector where substandard labour conditions are frequently the norm. The formalisation of ASM can bring benefits to the sector, but it necessitates legislative changes and substantial investments.

Exploring bottom-up approaches to policymaking might be worth considering. However, not all mining of energy transition materials is associated with poor labour conditions. In some cases, mining operations can offer employment opportunities that are much-needed, thus benefiting economically marginalized regions. Beyond labour conditions, the mining sector is responsible for about 10% of global greenhouse gas emissions.

It is possible to further reduce emissions from mineral mining and processing through increased energy efficiency investments and a shift to cleaner fuels and low carbon electricity. Given the nature of mining activities, there is a strong need for actions to integrate biodiversity, implement waste reduction programmes, and alleviate water stress.

Promoting appropriate governance involves enhancing transparency, accountability, public participation, and governance frameworks. This includes addressing tax avoidance, inadequate tax frameworks, and directing mineral revenues towards industrial transformation and economic diversification.

If managed responsibly, the energy transition has the potential to promote inclusivity and stability by enhancing access to affordable and reliable energy, catalysing economic growth, and enhancing social and environmental outcomes.

The need for cooperation

Despite recent trends towards deglobalisation, paradoxically, the need for regional and global cooperation has never been more pronounced. The challenges embedded within the geopolitics of critical materials warrant collaborative solutions that transcend national boundaries. Multilateral cooperation must be forged to address the intricate challenges of resource scarcity, supply chain vulnerabilities, and geopolitical uncertainties.

No country alone can fulfil its demand for all critical materials, so collaborative strategies that benefit all involved need to be developed and implemented. As a result, critical material diplomacy has gained ground with countries establishing new alliances and partnerships to ensure access to these resources.

International cooperation plays a pivotal role in establishing transparent markets with cohesive standards and norms rooted in principles of human rights, environmental stewardship, and community engagement. The adoption of public sector standards, such as those set forth by the UN Guiding Principles on Business and Human Rights, the OECD Mineral Guidelines, and International Standards Organization (ISO) Committee on Rare Earths and Committee on Lithium, is imperative.

Active participation by countries in the development of international standards is essential for their engagement in trade and the subsequent benefits it offers. Venturing further, multi-stakeholder initiatives to promote responsible sourcing, sustainable production and transparency in the critical raw material supply chain and private cooperation are needed.

Undoubtedly, the journey towards a sustainable energy future relies on renewable technologies and energy storage, intricately linked to the responsible management of critical materials.

Through these collaborative efforts to secure supply chains, curb environmental impact, and ensure responsible governance, the advancement of economic growth, societal progress, and the attainment of climate targets can be realised.

Isaac Elizondo Garcia, Martina Lyons, Elizabeth Press, Francisco Boshell, Luis Janeiro are co-authors of IRENA’s ‘Geopolitics of the Energy Transition: Critical Materials report’.